haven't filed taxes in years canada

Luckily filing and paying your taxes is still possible even if you havent filed in a while. For each month that you do not file.

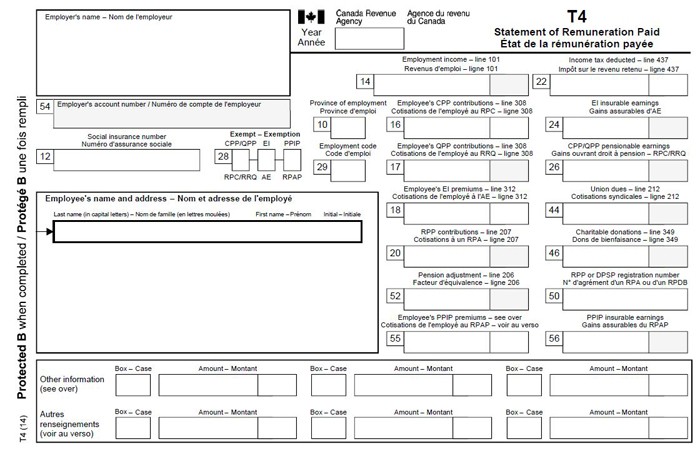

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

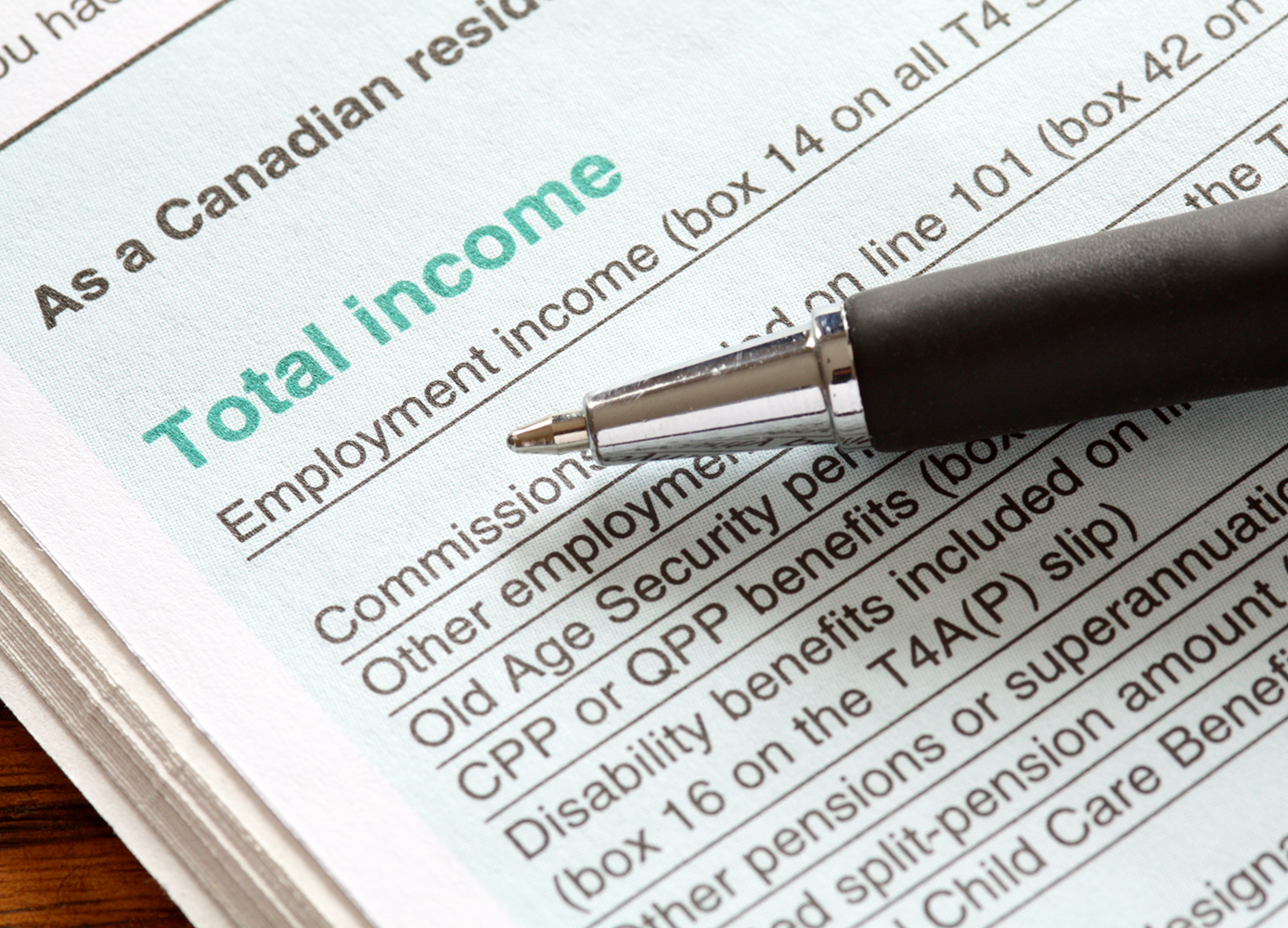

According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return.

. You can do this. As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late filing penalty of 5 percent of the tax owing. Were just about ready to send in our application and Im starting to get worried.

Heres what you need to know about. Start with a free consultation. Start by filing your taxes.

People fall behind all the time for many different reasons. Most Canadian income tax and benefit returns must be filed no later than April 30 2018. Get all your T-slips and what ever.

And make a payment plan with cra. Answer 1 of 24. Generally you have a 10-year limit on claiming taxes fees and interest on those that have gone unpaid for five years.

There is a penalty if you do not file tax returns by April 30 which is 5. How far back can you go to file taxes in Canada. Filing Taxes Late In Canada.

The IRS contacting you can be stressful. We work with you and the IRS to resolve issues. If you go to genutax httpsgenutaxca you can file previous years tax returns.

The IRS contacting you can be stressful. Start with the 2018 one and then go back to 2009 and work your way back. For the sponsors employment section I wrote that I dont have a notice of assessment.

Self-employed workers have until June 15 2018 to file their tax return. Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law If you owe taxes and did not file your income tax return on time the cra will charge you a late filing penalty. If you have a job your employer is already.

Once you file they will take your back gst. You dont have to file taxes if There are very few circumstances that excuse your. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign.

It wont be as bad as you think. With years of experience in corporate and personal tax law Filing Taxes is your premier partner for all your tax needs in becoming up to date with your tax filing obligations. Start with a free consultation.

If you owe money to the CRA you will endure a late filing penalty of 5 of your unpaid taxes plus 1 a month for 12 months from the filing due date. Take a deep breath. I havent filed my taxes for previous years how can I file these tax returns.

The longer you go without filing. If you do not pay up by May 31 you are subject to a 6 penalty each month thereafter as well as one. Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every month.

As long as you have filed a tax return in the past with the CRA and we have the correct information on file for you. It wont get rid of your debt to cra anyway. Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more.

I wouldnt file for bankruptcy over 12000. Due to the coronavirus pandemic the Canada Revenue Agency has made a number of changes to the traditional income tax filing this year. We work with you and the IRS to resolve issues.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. Ad Need help with Back Taxes. Have you been contacted by or acted upon Canada.

Failure to file a tax return. Contact the CRA. That said youll want to contact them as soon as.

However if you dont file the tax return for any year then. Ad Need help with Back Taxes.

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

The Penalties For Late Tax Filing 2022 Turbotax Canada Tips

How Far Back Can The Irs Go For Unfiled Taxes

Don T Wait Any Longer To File Your Taxes Good Times

Grand Prince Hotel Mirpur 1216 Dhaka World Hotel Reviews Hotel Reviews Hotel Outdoor Swimming Pool

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

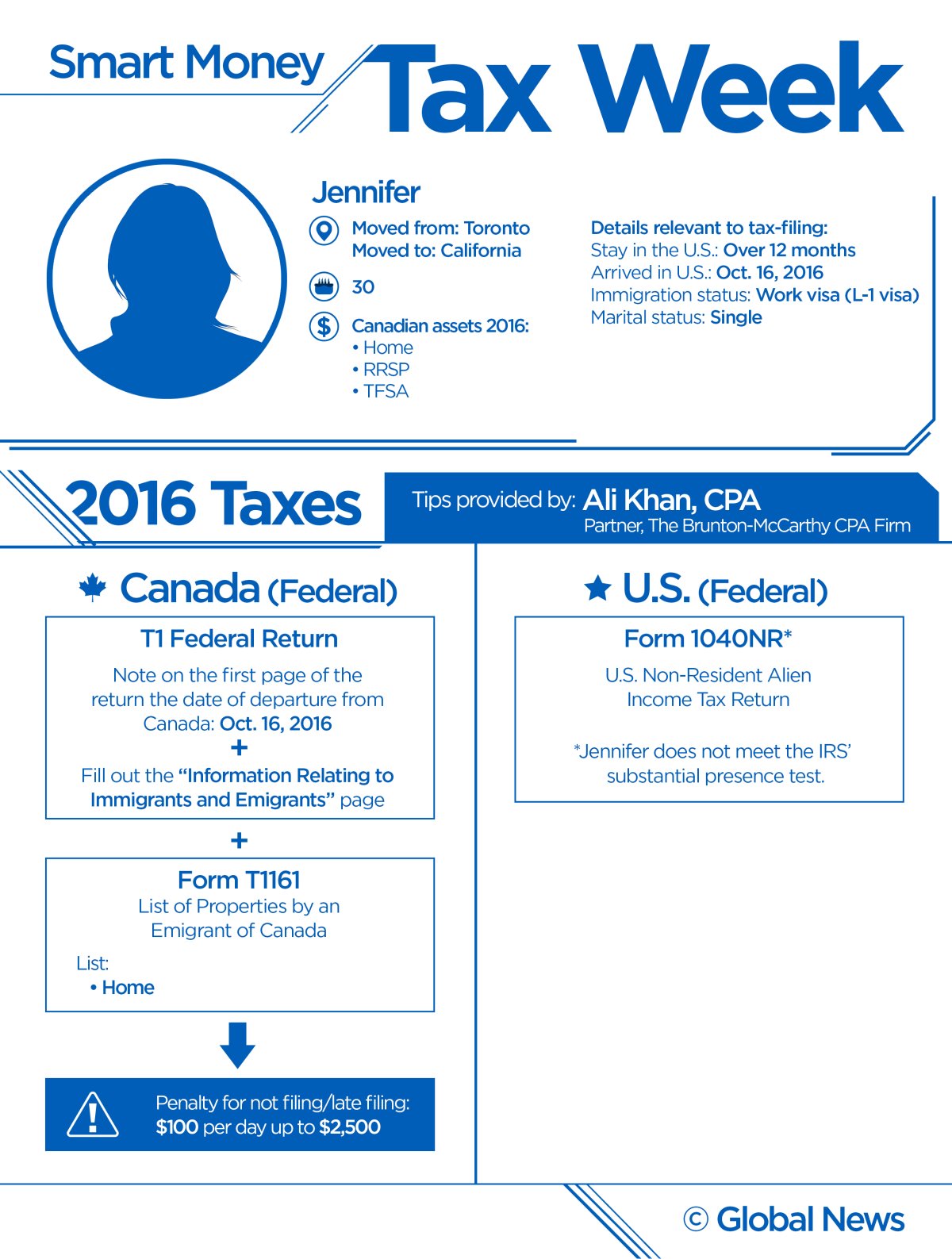

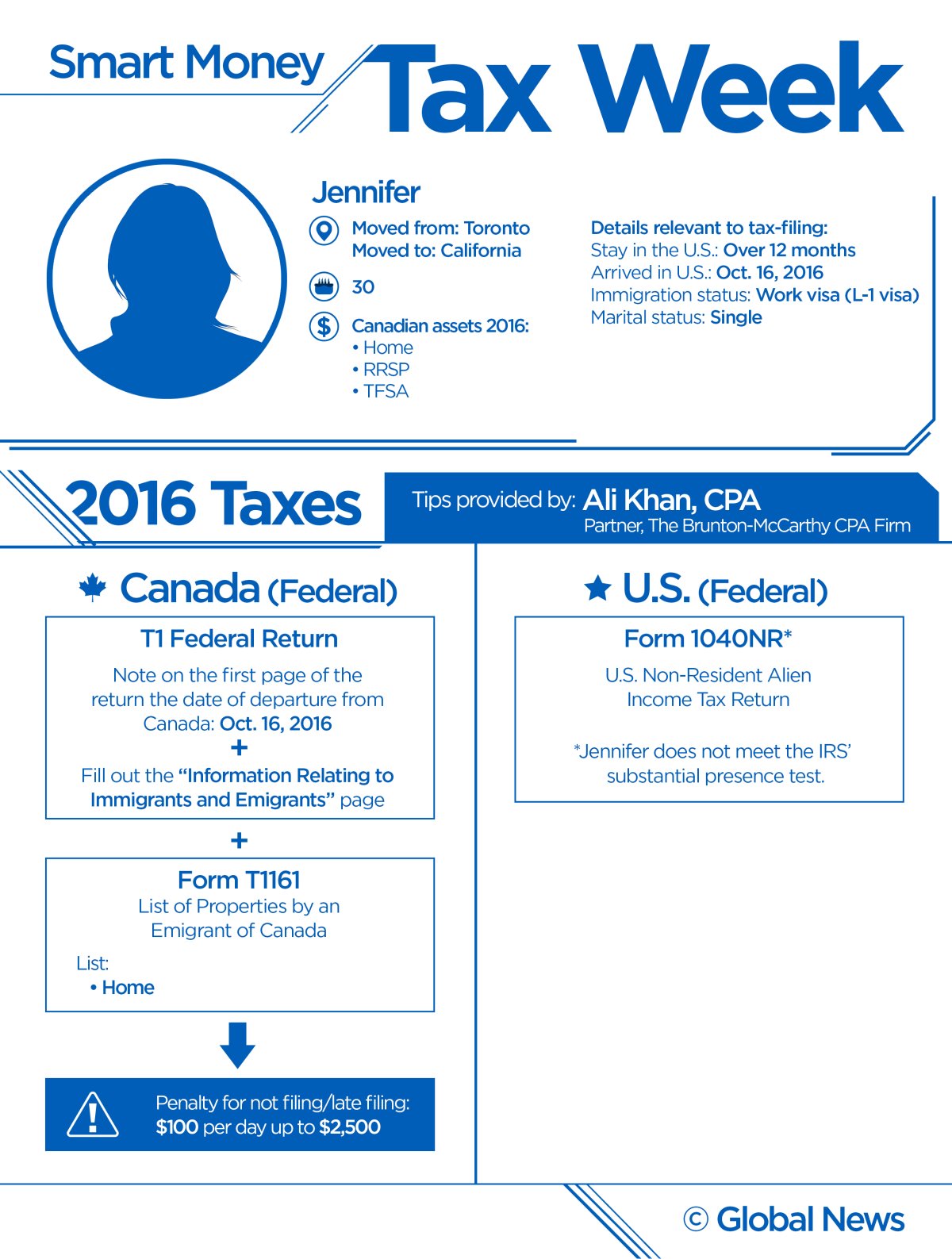

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Canadians Plan Ahead This Tax Season With These New Changes Kashoo

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Tax Tip Do I Have To File Taxes In Canada Every Year 2022 Turbotax Canada Tips

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 2017 As An Example Youtube

What To Do If You Haven T Filed Your Taxes In A Few Years Or More

تويتر Canada Revenue Agency على تويتر Haven T Filed Yet If You Re Filing Electronically With Netfile You Ll Be Asked To Enter An Access Code Before You Submit Your Return You Can

Grand Prince Hotel Mirpur 1216 Dhaka World Hotel Reviews Hotel Reviews Hotel Outdoor Swimming Pool

Priyankamadan I Will Do Income Tax And Gst For India For 5 On Fiverr Com Economics Project Goods And Service Tax Goods And Services

If They Haven T Already Arrived Property Valuations Are Coming Your Way Soon If You Believe The Market Value Of Y Property Valuation Real Estate Market Value